Az Gambling Tax

NOTICE

In person self-exclusions will not be available until further notice. Please do not let this stop you from excluding yourself or receiving the help you may need. The self-exclusion administrator is available to answer your questions and can be reached at 602.255.3843 or by email at [email protected]. The self-exclusion form is available on this website and can be mailed to the office after being notarized. Pictures can be emailed or attached to the form. In addition to self-exclusion, we offer Tribal and State funded treatment from our list of treatment providers. The list of providers can be found on this site.

What is Self Exclusion?

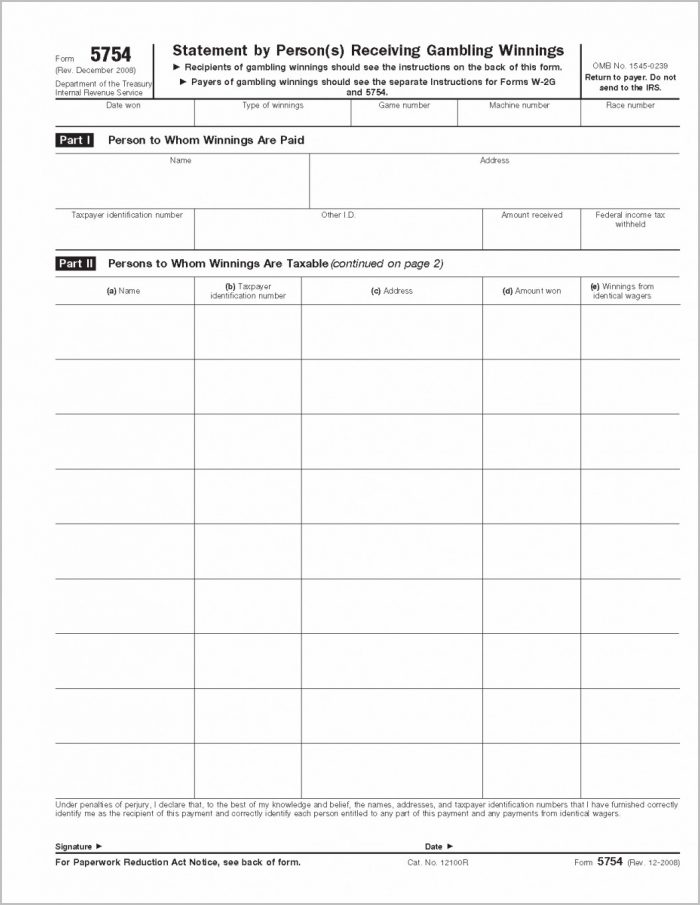

But beginning with the tax year 2018 (the taxes filed in 2019), all expenses in connection with gambling, not just gambling losses, are limited to gambling winnings. What About State Taxes? In addition to federal taxes payable to the IRS, many state governments tax gambling income as well. There are two main tax benefits of filing taxes as a professional gambler. First, it allows you to net your wins and losses which leads to a much lower AGI which in turn affects a great deal of tax deductions. Second, it allows you to deduct expenses incurred while gambling such as food, travel, and equipment. States With Low Tax Rates on Gambling Wins. Most states do tax you to some degree regarding winnings, and some states have a high gambling tax. However, the following ones don’t take much from you. The Grand Canyon State provides tribal casinos, horse tracks, and charity gaming. Arizona features a relatively low 4.54% tax rate on. Hey, working on a new client who needs to file an Arizona non resident return due to gambling income. The set up of the Arizona return is really screwing with me here. They lost 1.4M gambling but the limitation on gambling deductions and apportioning that deduction turns a 1.4M loss into 190K of income. Federal 1040 has 450K gambling income.

Self-Exclusion is a process that allows a person to request to be banned from all Indian Gaming Facilities within the State of Arizona and to be prohibited from collecting any winnings, recovering any losses, and the use of any of the services or privileges of the facility. You can choose either a one year, five year, or ten year exclusion.

Self-Exclusion is a process that allows a person to request to be banned from all Indian Gaming Facilities within the State of Arizona and to be prohibited from collecting any winnings, recovering any losses, and the use of any of the services or privileges of the facility. You can choose either a one year, five year, or ten year exclusion. This exclusion is irrevocable and cannot be altered or rescinded for any reason during the time period elected on the form.

How do I exclude myself?

There are a number of ways you can go about excluding yourself. You can download the exclusion form found on this site, fill it out, have it notarized and mail it to the Department of Gaming along with a current photo of yourself. Please note: The self-exclusion will not be processed without proper notarization and a current photo. The photo may be submitted electronically via email; however, the original, notarized self-exclusion form must be mailed or delivered to this office.

You may also come to the office to complete the entire self-exclusion process which includes meeting with the self-exclusion administrator who will discuss the program, notarize the form and take your photo as well as give you additional resources for problem gambling. Appointments for self-excluding in our office are Monday, Wednesday and Thursday 8 a.m. - 3 p.m. It is recommended to call in advance to confirm the Self-Exclusion Administrator will be available.

Please click on the FAQ link to the right for more information.

Ban yourself from Arizona Casinos

The self-exclusion procedures and the self-exclusion forms are in a PDF format. To obtain a free copy of Adobe Reader, click here.

Download a copy of: Self-Exclusion Procedures; Self-Exclusion Form (Fillable)

Ban yourself from using ATMs at many casinos

The Everi STeP program allows you to exclude yourself from using ATMs at over 1000 gambling locations.

Automated Systems America, Inc. (ASAI) can also assist in blocking ATM transactions in some Arizona casinos.

Ban yourself from internet gambling

Az Gambling Tax Rate

Gamblock prevents access to internet gambling sites.